Third-quarter 2024 sales

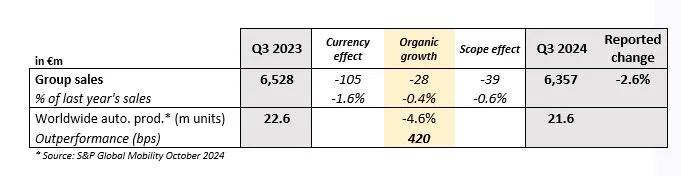

Q3 2024 sales of €6.4bn, an outperformance of 420bps in a challenging environment

SALES OUTPERFORMED WORLDWIDE AUTOMOTIVE PRODUCTION BY 420 BASIS POINTS IN Q3 2024, ABOVE H1 2024 OUTPERFORMANCE

- By Business Group, outperformance was driven by Seating, Interiors, Lighting, and Electronics.

- By region, Group’s outperformance was driven by Europe and North America.

- Excluding negative geographical mix, outperformance stood at 480bps.

BUILDING UP SUSTAINABLE PROFITABLE GROWTH THROUGH CUMULATED ORDER INTAKE ABOVE €20bn SINCE THE START OF THE YEAR

- Asia representing 36% of the cumulated 9-month order intake, including significant awards with new Chinese OEMs such as Chery, Li Auto and a fast-growing EV manufacturer.

- Targeting around €30bn in 2024, while maintaining a selective approach to order intake, both in terms of profitability and upfront costs.

IN ITS RECENT PRESS RELEASE ISSUED ON SEPTEMBER 27, 2024, FORVIA UPDATED ITS FY 2024 GUIDANCE TO :

- Sales of between €26.8bn and €27.2bn

- Operating margin of between 5.0% and 5.3% of sales

- Net Cash Flow (NCF) ≥ €550m

- Net debt/Adjusted EBITDA ratio ≤ 2.0x at year-end,

FORVIA CONFIRMS ITS TOP PRIORITY TO DELEVERAGING, WITH UNCHANGED TARGET OF NET DEBT/ADJUSTED EBITDA RATIO < 1.5X AT END-2025, SUPPORTED BY DISPOSAL PROGRAM UNDERWAY ON TOP OF IMPROVEMENT IN CASH-FLOW GENERATION.

Patrick KOLLER, Chief Executive Officer of FORVIA, declared:

“In the third quarter, we continued to post a robust organic sales outperformance of 420 basis points vs. a worldwide automotive production that was down 4.6% year-on-year. This outperformance demonstrates our capacity to resist to a challenging environment, as flagged in our recent press release on September 27.

Uncertainty remains high in the European market, impacted by a slowdown of electrification and concerns related to the CAFE regulation, while the North American market is suffering from high level of car inventories. In both regions, we outperformed the local automotive production.

In China, conversely and as expected, we underperformed the local automotive production in the past quarter, due to customer mix evolution and SOPs delayed from 2024 to 2025. In a Chinese market that is expected to grow in 2025, we confirm that we should resume outperforming the automotive production in the country by at least 300 basis points.

The order intake signed in the past quarter brings to more than €20 billion the cumulated amount since the start of the year, with a well-balanced mix of customers and geographies, and Asia representing around 36% of this amount. While pursuing our selective approach to order intake, we are targeting €30 billion in the full year 2024.

We remain focused on maintaining our efforts and accelerating measures, such as EU-FORWARD competitiveness program in Europe and cost synergies with FORVIA HELLA, that will ensure the resilience of our performance in the rest of the year, as well as significantly improve our performance in 2025, even if the environment remains challenging. Deleveraging the company and strengthening its balance-sheet remains our top priority.”

Related documents |

Download all | 1.82 MB | |

|---|---|---|---|

| Press release | 21th October 2024 | 473.68 KB | |

| Slideshow | 21th October 2024 | 1.62 MB |